Janiye debit card se paise kaise transfer kare online ka best tarika. Step-by-step guide, apps, charges aur FAQs 2025 mein full Hindi + English mein.

Introduction

Aaj ke digital era mein online money transfer ek common necessity ban chuka hai. Chahe aapko family ko emergency mein paisa bhejna ho, kisi friend ki help karni ho ya online shopping ke liye payment karna ho – debit card se paise transfer karna sabse easy aur secure option hai.

Is article mein hum detail mein samjhenge ki debit card se paise kaise transfer kare online, kaunse apps aur platforms best hain, kya charges lagte hain, aur security tips jo aapko dhyan mein rakhne chahiye.

Debit Card Kya Hai?

Debit card ek bank-issued card hota hai jo directly aapke bank account se linked hota hai. Jab bhi aap debit card ka use karte ho, transaction amount directly aapke account se deduct ho jata hai. Ye credit card se alag hai, kyunki ismein aapko udhaar nahi milta – sirf apne hi account ka paisa use karte ho.

Debit Card Se Paise Kaise Transfer Kare Online Ke Popular Tarike

1. Mobile Banking Apps

Har bank ka apna mobile banking app hota hai, jaise:

- SBI YONO

- HDFC Mobile Banking

- ICICI iMobile Pay

- Axis Mobile App

Aap apna debit card link karke directly IMPS, NEFT, RTGS ke through paisa transfer kar sakte ho.

2. UPI Apps (Unified Payments Interface)

UPI India ka sabse fast aur popular method hai money transfer ka.

- Google Pay

- PhonePe

- Paytm

- BHIM App

Yahaan debit card se UPI PIN set karna hota hai. Ek baar PIN set ho gaya toh aap instant money transfer kar sakte ho 24×7.

3. Net Banking

Aap debit card ke details dal kar net banking activate kar sakte ho. Phir beneficiary add karke NEFT/IMPS ke through transfer possible hai.

4. Digital Wallets

Paytm Wallet, Amazon Pay, Freecharge jaise wallets mein bhi aap apna debit card add karke paise load kar sakte ho aur fir transfer kar sakte ho.

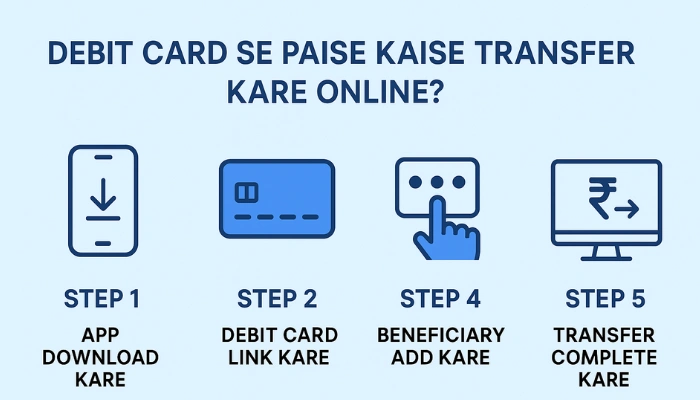

Step-by-Step Guide: Debit Card Se Paise Transfer Kaise Kare Online?

Step 1: App Download Kare

Apne bank ka mobile banking app ya UPI app (PhonePe, Google Pay) install kare.

Step 2: Debit Card Link Kare

UPI ya app mein debit card number, expiry date aur CVV dal kar verify karein.

Step 3: UPI PIN Set Kare

Debit card ke last 6 digits aur expiry date se OTP generate hoga. Uske baad aapko ek 4 ya 6 digit ka UPI PIN set karna hoga.

Step 4: Beneficiary Add Kare

Jis person ko paise bhejne hain unka UPI ID, mobile number ya account number add karein.

Step 5: Transfer Complete Kare

Amount enter karein → UPI PIN dalen → Transaction complete!

Debit Card Se Money Transfer Ke Fayde

- Instant Transfer – Seconds ke andar paisa transfer.

- 24×7 Available – Banking hours ka wait nahi karna padta.

- Secure & Verified – RBI aur bank ke security standards ke hisaab se safe.

- Easy to Use – Sirf mobile aur debit card se process complete.

Charges & Limits

- UPI Transactions: Mostly free (zero charges).

- IMPS: ₹5-₹15 per transaction (bank ke hisaab se).

- NEFT/RTGS: Some banks free kar chuke hain, lekin kuch mein nominal charges lagte hain.

- Daily Limit: Generally ₹1 lakh tak per day UPI transfer possible hai.

Safety Tips for Debit Card Online Transfer

- Apna UPI PIN kabhi kisi ke saath share na karein.

- Sirf verified apps (Google Pay, PhonePe, Paytm) hi use karein.

- Public Wi-Fi pe transactions avoid karein.

- Regularly apna bank statement check karein.

- Debit card ka CVV aur OTP secure rakhein.

FAQs – Debit Card Se Paise Kaise Transfer Kare Online

Q1. Kya debit card se Google Pay aur PhonePe par paise transfer kar sakte hain?

Haan, aap debit card se apna UPI PIN set karke Google Pay, PhonePe aur Paytm ke through instant transfer kar sakte ho.

Q2. Kya debit card se international money transfer possible hai?

Nahi, debit card se direct international transfer possible nahi hai. Lekin PayPal ya forex-enabled cards use kar sakte ho.

Q3. Debit card se paise transfer karne par kitna charge lagta hai?

UPI free hai, lekin IMPS/NEFT/RTGS mein bank ke hisaab se ₹5-₹25 tak charges lag sakte hain.

Q4. Debit card se ek din mein kitna paisa transfer kar sakte hain?

UPI ke through ₹1 lakh per day limit hoti hai. Banks ke apps mein IMPS/NEFT ki alag-alag limits hoti hain.

Q5. Kya debit card se wallet mein paisa add karke transfer karna safe hai?

Haan, lekin hamesha verified wallets (Paytm, Amazon Pay) ka use karein aur OTP secure rakhein.

Conclusion

Ab aapko clear idea ho gaya hoga ki debit card se paise kaise transfer kare online. UPI apps jaise Google Pay, PhonePe aur Paytm sabse fast aur secure option hai. Agar aapko high amount transfer karna hai toh net banking ya IMPS/RTGS best rahega.

Aaj hi apna debit card link karke online transfer try karein aur cashless India ka part banein!